Essar Shipping's stock sank yesterday on news of the failure of the tender offer to take the company private under SEBI's Delisting Regulations.

In a cryptic-sounding message, the company informed the following to the Mumbai stock exchange:

"Essar Shipping & Logistics Ltd has informed the Company pursuant to the approval of the shareholders for delisting of equity shares of Essar Shipping Ltd ("Target Company") from Bombay stock Exchange Ltd ("BSE") pursuant to SEBI (Delisting of Securities) Guidelines, 2003, The Essar Shipping & Logistics Ltd had made a Public Announcement for making an offer to the Public Shareholders of the Target Company in terms of the Guidelines.

The Reverse Book Building Process ("RBB") closed on March 16, 2007. As the aggregate number of shares tendered by the Public Shareholders was less than the number required to reduce the public shareholding of the Target Company to fall below minimum public shareholding determined as per the provisions of the Listing Agreement, the Delisting Offer has failed in terms of the Guidelines and no securities can be acquired pursuant to such Delisting Offer.

In light of the facts and law stated above, the Target Company will continue to remain listed on BSE. The shares deposited in the Special Depository Account of the trading members during the RBB will be returned to the respective public shareholders in accordance with the Guidelines."

If you were a shareholder in Essar Shipping, your situation was analogous to that of one of the prisoners in the famous game of prisoners' dilemma. You could either sell your shares in the market, or you could tender them to the offerer.

If you tendered, then the offerer would return your shares if the total number of shares received were less than the minimum required (this is what happened in this case) or if the book-built price arrived at after the tender was over was rejected by the offerer as too high. (this is what happened in the Blue Dart case a few months ago).

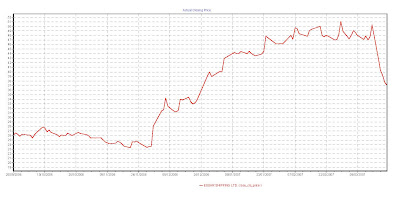

Both these outcomes take place AFTER the tender offer is over, by which time its too late to sell the tendered shares in the market (in the absence of futures trading) because you don't have them with you. So, a failed offer, typically results in a crash, as the above chart depicts.

Viewed from your own perspective, the correct strategy is to sell the stock in the market rather than tendering it - the above chart shows that those investors who followed this advice would have fared well.

The problem, of course, is that if everyone follows this advice, then the tender offer must fail!

A nice little prisoners' dilemma embedded inside the SEBI's Delisting Regulations...